Overview of FRx’s add-on currency translation module

Now that currency translation with Excel is out of the way, here’s a brief overview of how it’s done with DAX, an FRx add-on. I’ll show a translated balance sheet first, then a consolidated income statement.

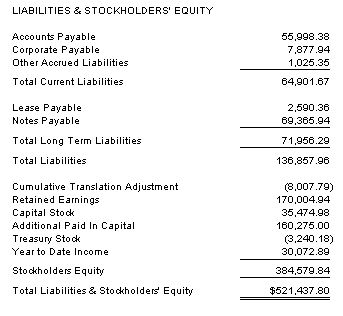

So here’s the balance sheet for Canadian dollars translated to US Dollars:

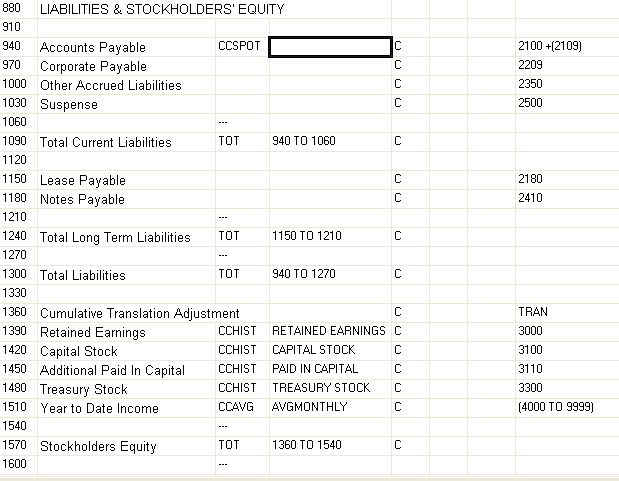

And here’s part of the row format for this balance sheet. The Format Code column is used to specify the rate, noting that once a rate is assigned to a particular row, it’s good until another one is specified. That’s why you only see CCSPOT once. For historical rates, you’ll assign a historic rate id and for average rates, a calculation methodology. Anyway, these rates are maintained in tables.

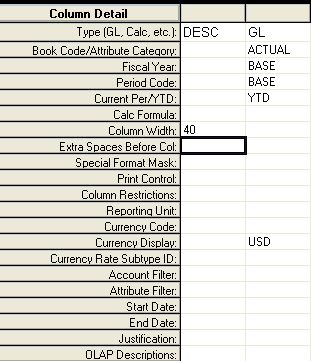

And this is the related column. Pretty standard except for the currency display. This shows USD because this is a Canadian company being translated to US Dollars.

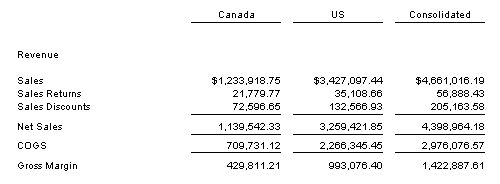

As with Excel, the translation gain or loss is calculated with a Rounding Adjustment. That’s it for the balance sheet…now on to the consolidated income statement:

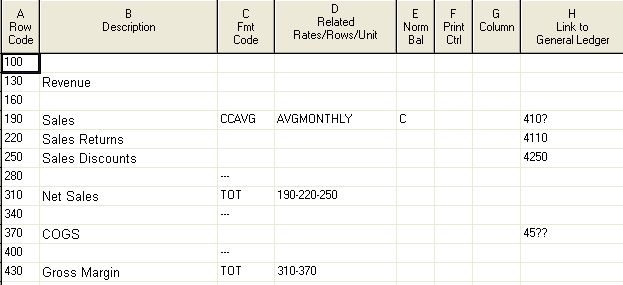

The row format is pretty simple compared to the balance sheet. It’s just an average rate in this case, with a monthly methodology specified:

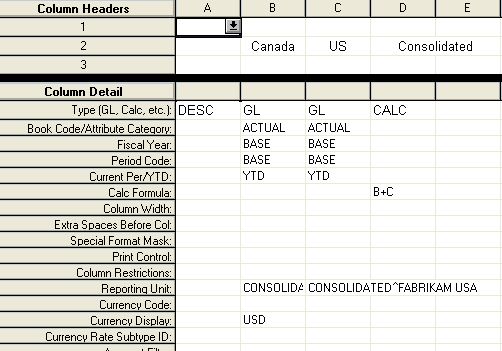

And the column is pretty standard, too, except for the USD specified in Currency Display for Canada:

There’s much that this article leaves out, but at least we’re touching on the concepts of how FRx handles currency.

Leave a Reply